When it comes to understanding mortgages, there are several complex terms that can leave you scratching your head. But don't worry, we're here to clear up some of that confusion and help you make sense of it all.

Reverse Mortgage

A reverse mortgage is a type of loan that allows homeowners who are 62 years or older to convert part of their home equity into cash without having to sell their home or make monthly payments. The loan is repaid when the borrower leaves the home for an extended period of time, either due to death or moving out permanently.

While a reverse mortgage can be a great option for retirees who need cash, it's important to understand the fees and interest rates associated with this type of loan.

Mortgage Payoff

Mortgage payoff refers to the process of repaying the remaining balance on your mortgage loan. This can be done in several ways, including making additional payments or increasing your monthly payments. Paying off your mortgage early can save you thousands of dollars in interest over the life of the loan.

Before making extra payments towards your mortgage, make sure to check with your lender to see if there are any prepayment penalties associated with paying off your loan early.

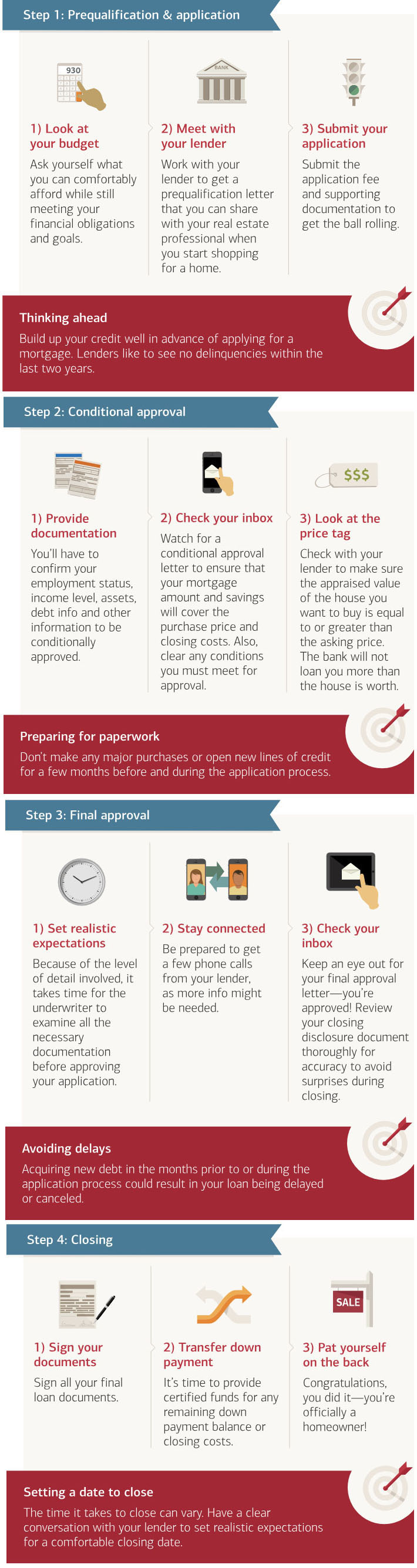

Mortgage Loan Process

The mortgage loan process can be confusing, but understanding the steps involved can help make the process smoother and less stressful. The process typically starts with a pre-approval, where the lender evaluates your credit score, income, and debt-to-income ratio to determine how much you can borrow.

Once you've been pre-approved, you can start searching for a home within your budget. Once you've found a home you like, you can move on to the loan application process. This involves submitting documentation such as tax returns, pay stubs, and bank statements. The lender will review your application and determine whether to approve the loan or not.

Homebuyer Guide

If you're a first-time homebuyer, navigating the mortgage process can be overwhelming. That's why it's important to have a homebuyer guide that offers valuable insights and advice to help make the process easier.

A homebuyer guide typically covers topics such as mortgage pre-approval, selecting a real estate agent, home inspections, and closing costs. It's a great resource to consult throughout the home-buying process and can help you avoid costly mistakes.

Now that you have a better understanding of some common mortgage terms, you can make more informed decisions when it comes to your finances. Remember to always do your research and consult with a qualified professional before making any major financial decisions.