Are you considering refinancing your mortgage? Perhaps you're looking for ways to tap into your home equity and want to learn more about the options available to you. In this article, we'll explore the world of mortgage refinancing and the benefits of cash-out refinances. Let's dive in!

Understanding Mortgage Refinancing

Mortgage refinancing is the process of replacing your current mortgage with a new one. The purpose of refinancing is to obtain better interest rates, change the loan term, or extract equity from your home. The most common type of refinancing is rate-and-term refinancing, which entails getting a new mortgage with a lower interest rate or a longer loan term. But there's another type of refinancing that many homeowners are not aware of – cash-out refinancing.

The Cash-Out Refinance

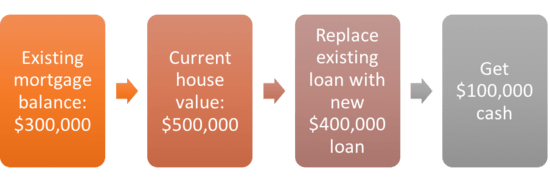

A cash-out refinance is a type of mortgage refinancing that involves borrowing more than the amount required to pay off your current mortgage, thus acquiring some of the equity in your home. The proceeds of a cash-out refinance loan can be used to pay off high-interest debt, make home improvements, or invest in other ventures.

The benefit of a cash-out refinance is that the interest rate on the loan is typically lower than other forms of consumer credit, such as credit cards or personal loans. Additionally, the interest paid on the loan may be tax-deductible, making it an attractive option for homeowners looking to consolidate high-interest debt.

Reasons to Consider a Cash-Out Refinance

There are many reasons why homeowners choose to pursue a cash-out refinance. Here are just a few:

- Debt Consolidation: Homeowners can use the proceeds from a cash-out refinance to pay off high-interest debt, such as credit cards or personal loans. This can lower monthly payments and reduce overall interest expenses.

- Home Renovations: With the proceeds from a cash-out refinance, homeowners can make home improvements or repairs that can increase the value of their property. This may include renovating a kitchen or bathroom, adding a room, or updating landscaping.

- Investing: Some homeowners choose to use the proceeds from a cash-out refinance to invest in other ventures, such as stocks, bonds, or real estate.

- Emergency Expenses: In times of unforeseen expenses, such as medical emergencies or unexpected home repairs, homeowners may choose to tap into their home equity with a cash-out refinance to cover the expense.

The Mortgage Refinance Guide

If you're considering a mortgage refinancing, it's important to educate yourself on the options available to you. The Mortgage Refinance Guide from FREEandCLEAR is a comprehensive resource that can help you make an informed decision about refinancing your home loan.

In the guide, you'll learn about the different types of refinancing, the pros and cons of each option, and how to qualify for a loan. Additionally, the guide provides helpful tools and calculators that can help you estimate your monthly payments, closing costs, and other fees associated with refinancing.

The Cash-Out Refinance Calculator

If you're considering a cash-out refinance, the Cash-Out Refinance Calculator from Weekend Landlords can help you estimate how much equity you can tap into and what your monthly payments will be.

The calculator takes into account your current mortgage balance, the value of your home, and the amount you wish to borrow. It also factors in the interest rate, loan term, and any additional fees associated with the loan, such as closing costs or insurance.

Seven Reasons to Refinance Your Mortgage

If you're still unsure about whether mortgage refinancing is right for you, check out this article from The Truth About Mortgage. It lists seven reasons why refinancing may be a smart move for homeowners, including:

- Lower Interest Rates

- Shorter Loan Terms

- Cash-Out Refinancing

- Debt Consolidation

- Elimination of PMI

- Switching from an ARM to a Fixed-Rate Mortgage

- Reducing Monthly Payments

The article goes into detail on each of these points, providing real-world examples and helpful tips for homeowners considering a refinance.

Conclusion

Refinancing your mortgage can be a smart move for homeowners looking to reduce their monthly payments, tap into their home equity, or consolidate high-interest debt. The Mortgage Refinance Guide, Cash-Out Refinance Calculator, and Seven Reasons to Refinance Your Mortgage can help you make an informed decision about whether refinancing is right for you. Happy refinancing!