Are you feeling the weight of your student loans? Don't worry, you're not alone. It's a common struggle that many graduates face. But with a little bit of effort, you can quickly pay off your loans and be on the path to financial freedom. Here are seven tips to help you do just that.

Tip #1: Make Extra Payments

The first and easiest way to pay off your student loans is to make extra payments. This may seem like a no-brainer, but it's one of the most effective ways to quickly reduce your debt. If you're able to make additional payments, do so. Even if it's just a little bit each month, it will add up over time and help you pay off your loans faster.

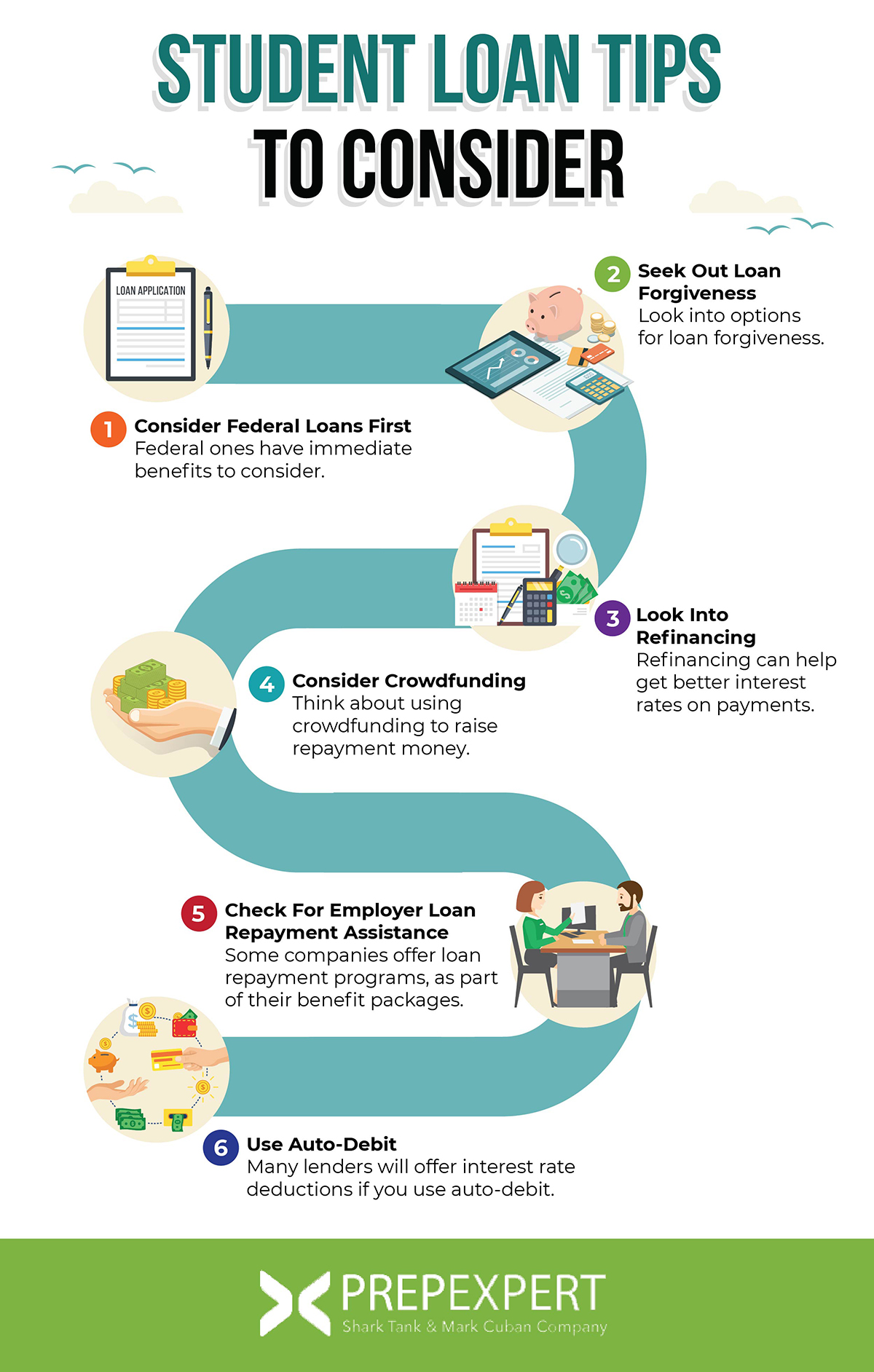

Tip #2: Consider Consolidation or Refinancing

If you have multiple loans with different interest rates, it may be worth considering consolidation or refinancing. This can simplify your payments and potentially lower your monthly payment amount. However, keep in mind that if you extend the repayment term, you may end up paying more in interest over time.

Tip #3: Enroll in Auto-Pay

Enrolling in auto-pay can help you save money in the long run by reducing your interest rate. Many lenders offer a discount on your interest rate if you set up automatic payments. It's a simple way to ensure you're making your payments on time and saving money at the same time.

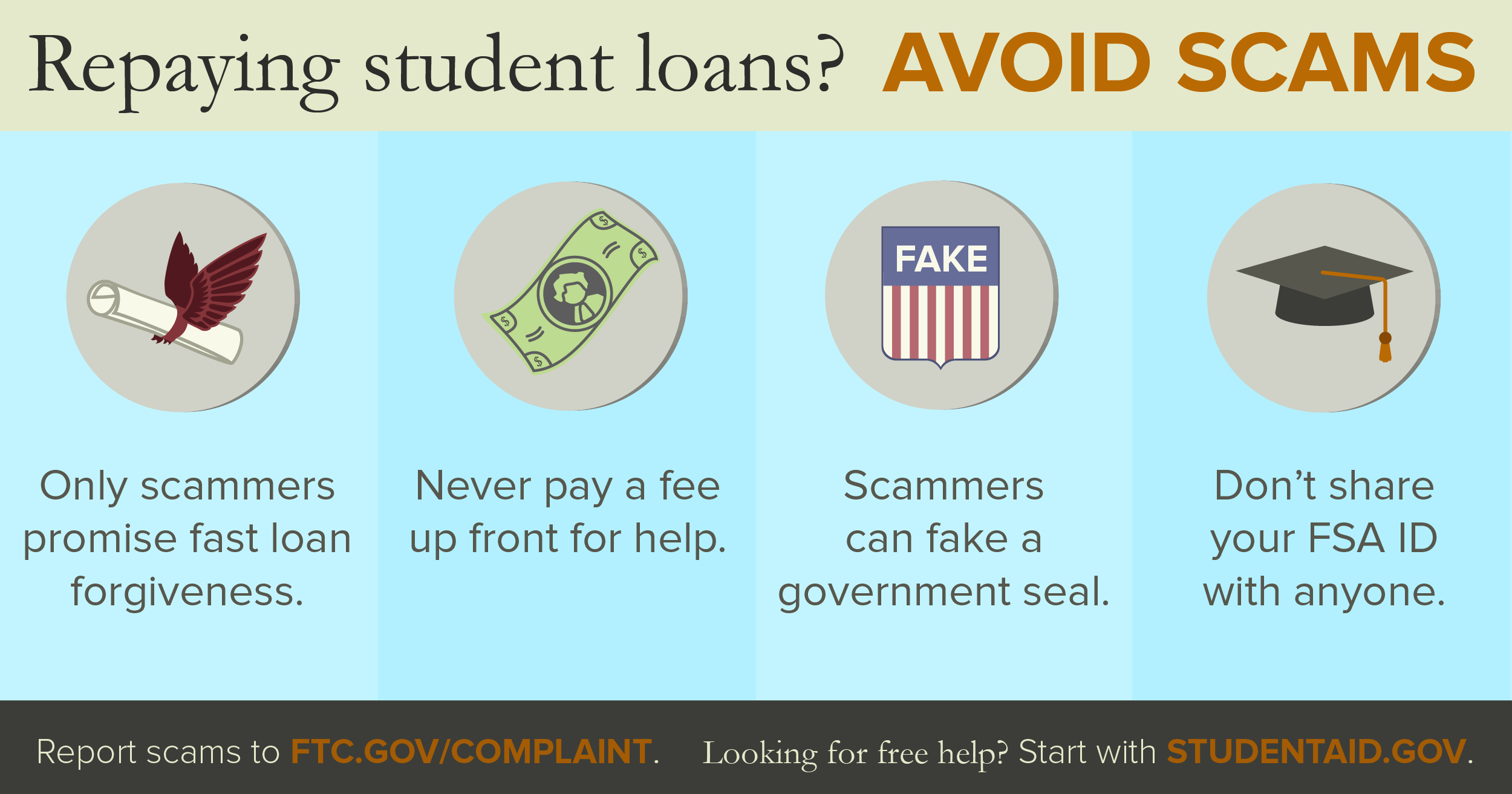

Tip #4: Look into Forgiveness Programs

Depending on your career path, you may be eligible for student loan forgiveness programs. These programs can help eliminate some or all of your student debt. However, they typically require a minimum number of years of service or have other criteria that must be met.

Tip #5: Increase Your Income

If you're struggling to make ends meet, consider increasing your income. This can be done by taking on a part-time job, freelancing, or asking for a raise at your current job. Every little bit helps, and the extra income can go directly towards paying off your loans.

Tip #6: Create a Budget

Creating a budget is a helpful tool for managing your finances and paying off your loans. Start by figuring out your monthly income and expenses. Then, look for areas where you can cut back on spending and redirect those funds towards your loans. It may take some sacrifice, but it will be worth it in the long run.

Tip #7: Stay Motivated

Finally, it's important to stay motivated throughout the process. Paying off your student loans can be a long and difficult journey, but it's worth it in the end. Keep a positive attitude, celebrate your small victories, and remember why you started. With determination and hard work, you can be debt-free sooner than you think.

In conclusion, paying off student loans can be a daunting task, but there are several strategies you can employ to make it easier. By making extra payments, consolidating or refinancing, enrolling in auto-pay, looking into forgiveness programs, increasing your income, creating a budget, and staying motivated, you can quickly pay off your loans and be on the path to financial freedom. So roll up your sleeves and get to work – your debt-free future is waiting!