Loans are a fundamental part of our modern economy. There are various loans available in the market that cater to a wide range of needs. As a business owner or an individual, understanding the different loan options available is crucial in making informed financial decisions. This article aims to explore some of the different types of loans available in the market.

VA Loans

VA loans are a type of mortgage loan that is guaranteed by the U.S. Department of Veterans Affairs. These loans are only available to veterans, active-duty service members, and eligible surviving spouses. VA loans offer benefits such as lower interest rates, no down payment requirements, and no private mortgage insurance requirements. Qualifying for a VA loan is different from traditional loans as they have different credit score, income, and debt-to-income ratio requirements.

Personal Loans

Personal loans are unsecured loans that can be used for a variety of personal expenses such as medical bills, home renovation, or debt consolidation. These loans are issued based on the borrower's creditworthiness and ability to repay, without any collateral requirement. Interest rates for personal loans vary depending on the borrower's credit score and financial status.

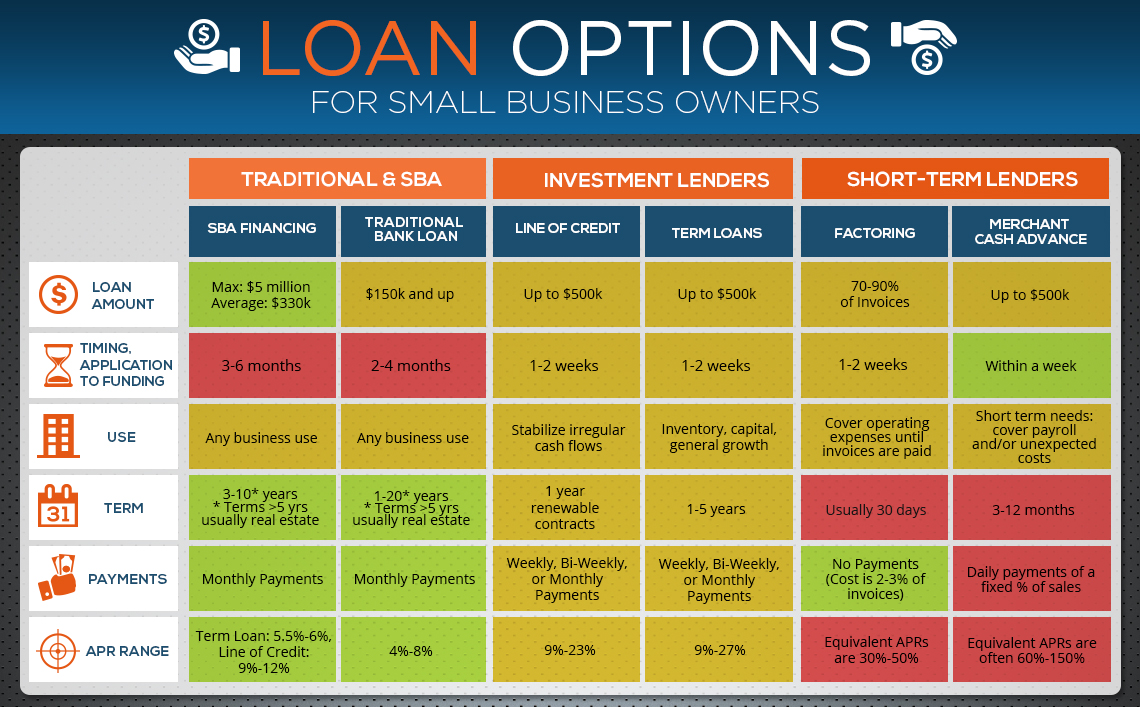

Business Loans

Business loans are designed to provide funding to businesses for various reasons such as expansion, inventory purchase, or equipment upgrades. These loans can be secured or unsecured, and they typically require collateral or a personal guarantee from the business owner. Interest rates for business loans vary depending on the risk involved and the creditworthiness of the borrower.

Home Loans

Home loans are used to finance the purchase of a home or property. These loans can either be secured or unsecured, with secured loans requiring collateral such as the property being purchased. Home loans typically have a fixed or adjustable interest rate and have a long-term repayment plan.

Auto Loans

Auto loans are used to finance the purchase of a vehicle. These loans can be secured or unsecured and typically require collateral such as the vehicle being purchased. Auto loans typically have a fixed interest rate and a repayment term of 3-7 years.

Debt Consolidation Loans

Debt consolidation loans are used to pay off existing debts and consolidate them into one loan with a lower interest rate. These loans can be either secured or unsecured, and the interest rates vary depending on the borrower's credit score and financial status.

In conclusion, choosing the right type of loan depends on the borrower's financial situation and needs. It is crucial to understand the different types of loans available in the market before making any financial decisions. Seeking guidance from a financial advisor or loan expert can help in making informed decisions and minimizing financial risks.