If you're thinking about purchasing a car, it's essential to familiarize yourself with car loans and how they work. A car loan is a type of loan where you borrow money from a lender to buy a vehicle, and then you repay the loan amount in regular installments over a certain period.

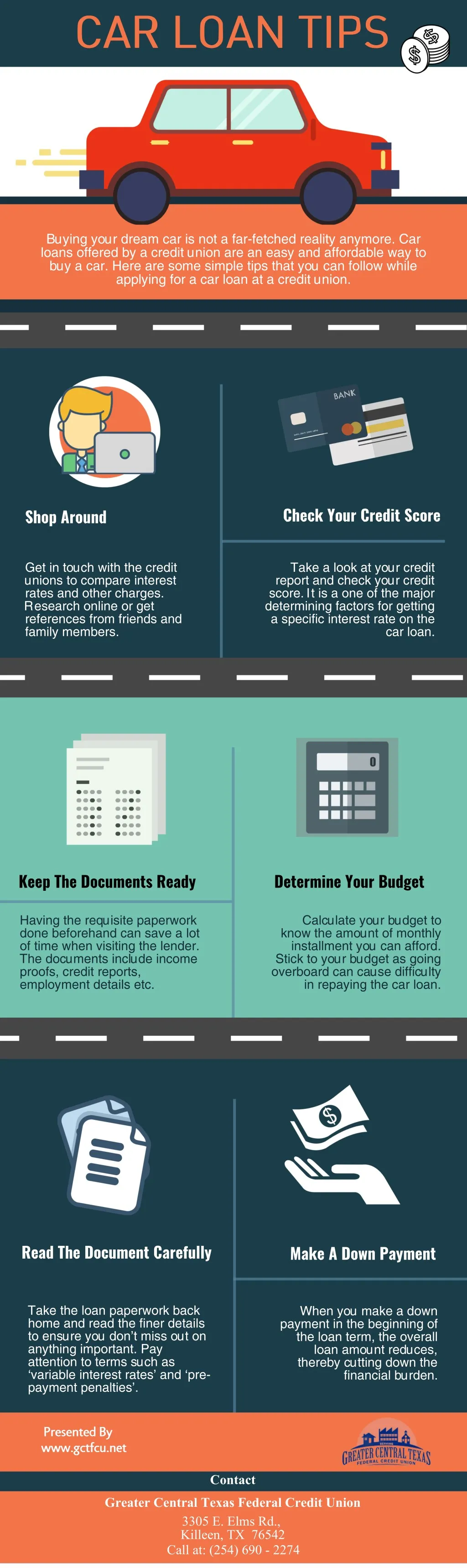

Car Loan Tips

When it comes to taking out a car loan, there are some important things to keep in mind. Here are a few tips that can help you get a better deal:

- Shop around for the best interest rates and terms

- Consider making a larger down payment

- Know your credit score and credit history

- Read the fine print of any loan agreements before signing

- Choose a loan term that fits your budget

Signs You're Ready for a Car Loan

If you're considering taking out a car loan, here are some signs that indicate you might be ready:

- You have a stable source of income

- You have a good credit score

- You've done your research and know which car you want to buy

- You understand the costs associated with car ownership (insurance, maintenance, etc.)

Factors That Affect Car Loan Approval

Getting approved for a car loan can be challenging, but there are some factors that can affect your chances of success:

- Your credit score and credit history

- Your income and employment history

- The amount of money you're requesting to borrow

- The length of the loan term

- The age and condition of the car you plan to purchase

How to Get Out of an Upside Down Car Loan

If you find yourself stuck in an upside down car loan (where you owe more on the car than it's worth), there are a few options you can explore:

- Sell the car and use the proceeds to pay off the loan (you may have to add some extra cash to cover the difference between what you owe and what the car sells for)

- Trade in the car for a less expensive vehicle and use the trade-in value to pay off the loan

- Refinance the loan with a shorter term and lower interest rate

Regardless of which option you choose, it's essential to take action as soon as possible to avoid further financial strain.

Overall, taking out a car loan can be a big financial decision, so it's important to do your research and consider all the factors before signing on the dotted line. By following the tips above and being mindful of your financial situation, you can find a car loan that works for you and helps you achieve your goals.